What net worth is considered rich is a question many people ask when comparing wealth levels, financial success, and lifestyle standards. Net worth includes assets like savings, investments, real estate, and cash minus liabilities such as debt.

Understanding wealth thresholds helps define what it means to be wealthy, financially stable, or affluent in today’s economy. This concept varies by income level, location, and long-term financial goals.

What Net Worth Is Considered Rich? Global Overview

What net worth is considered rich depends on global standards, cost of living, income distribution, and financial benchmarks used by economists. In most countries, a person is considered rich when their total assets such as cash, investments, property, and business equity significantly exceed their liabilities and place them in the top wealth percentile.

Globally, individuals with a net worth starting from one million dollars are often classified as wealthy, while higher tiers define financial independence and elite wealth status. These thresholds vary widely between developed and developing economies.

What Does “Rich” Actually Mean?

The meaning of rich goes beyond income and focuses on overall financial strength and lifestyle freedom. Being rich usually means having enough assets to maintain a high standard of living without relying solely on active income.

Key factors that define being rich include

- High net worth compared to the national average

- Ability to cover expenses through passive income

- Financial security against economic downturns

- Access to luxury lifestyle choices such as premium housing, travel, and investments

In financial terms, rich often refers to individuals who have achieved long term wealth accumulation and financial stability rather than just earning a high salary.

Difference Between Wealthy vs Rich

Although often used interchangeably, wealthy and rich have distinct meanings in financial planning and personal finance.

| Aspect | Rich | Wealthy |

| Income Source | High active income | Mostly passive income |

| Financial Stability | Short to medium term | Long term and sustainable |

| Net Worth Focus | Cash flow and earnings | Assets, investments, equity |

| Lifestyle | High spending power | Financial freedom and legacy |

Rich individuals may earn a lot but still depend on their job or business income. Wealthy individuals usually have diversified assets such as stocks, real estate, and businesses that generate consistent returns, making them less dependent on daily work.

Ultra-Wealthy vs High-Net-Worth Individuals

High net worth individuals and ultra wealthy individuals are classified based on asset value and investment capacity. These categories are commonly used by banks, investment firms, and global wealth reports.

- High net worth individuals typically have investable assets of one million dollars or more, excluding their primary residence

- Very high net worth individuals often hold assets exceeding five million dollars

- Ultra wealthy individuals usually have a net worth of thirty million dollars or more

Net Worth Thresholds by Country

Net worth thresholds vary by country due to differences in income levels, cost of living, property prices, taxation, and overall economic strength. What net worth is considered rich in one country may represent middle class status in another.

Below is a country wise breakdown using widely accepted financial benchmarks, wealth reports, and purchasing power standards, written for clarity and real user understanding.

What Net Worth Is Considered Rich in the United States?

In the United States, being rich is closely tied to household net worth and regional living costs. Generally, individuals in the top ten percent of wealth holders are considered rich.

| Wealth Level | Net Worth Range |

| Upper Middle Class | $1 million to $2 million |

| Rich | $2.5 million to $5 million |

| Very Wealthy | $10 million or more |

Due to high property values and investment culture, many Americans reach millionaire status through real estate, retirement accounts, and stock portfolios. Financial independence and passive income play a major role in defining wealth.

What Net Worth Is Considered Rich in California?

California has one of the highest costs of living in the world, especially in cities like San Francisco, Los Angeles, and San Diego. As a result, the definition of rich is significantly higher than the national average.

- Net worth of $3 million is often seen as financially comfortable

- $5 million or more is generally considered rich

- Ultra wealthy status typically starts above $20 million

High housing prices, state taxes, and lifestyle expenses mean that higher asset levels are required to maintain a wealthy standard of living.

What Net Worth Is Considered Rich in Canada?

In Canada, wealth concentration is influenced by real estate markets in cities such as Toronto and Vancouver.

| Category | Net Worth |

| Financially Secure | $1 million CAD |

| Rich | $2 million to $4 million CAD |

| Very Wealthy | $5 million CAD and above |

Canadians often build wealth through home equity, pensions, and long term investments. Being rich usually means owning property outright and having diversified investment assets.

What Net Worth Is Considered Rich in India?

India has a lower cost of living compared to Western countries, so the wealth threshold is significantly lower in numerical terms but high in relative status.

- Net worth of $250,000 to $500,000 USD is considered rich

- $1 million USD places an individual in the elite wealth class

- Ultra wealthy individuals often exceed $10 million USD

In India, wealth is commonly tied to business ownership, inherited assets, land holdings, and urban real estate.

What Net Worth Is Considered Rich in Australia?

Australia has a strong property market and high median household wealth, making millionaire status more common.

| Wealth Tier | Net Worth |

| Comfortable | $1.5 million AUD |

| Rich | $2.5 million to $4 million AUD |

| Very Wealthy | $5 million AUD or more |

Australians often accumulate wealth through superannuation, property investments, and long term financial planning.

What Net Worth Is Considered Rich in the United Kingdom?

In the United Kingdom, especially in London, wealth thresholds are heavily influenced by property prices and investment assets.

- Net worth of £1 million is considered wealthy

- £2 million to £3 million places someone in the rich category

- £10 million or more defines very high net worth individuals

Being rich in the UK often means owning valuable real estate, diversified investment portfolios, and having stable passive income sources.

What Net Worth Is Considered Rich in the Philippines?

In the Philippines, a relatively lower cost of living means that wealth thresholds are lower but carry high social status.

| Status | Net Worth |

| Upper Class | $150,000 to $300,000 USD |

| Rich | $500,000 USD or more |

| Very Wealthy | $2 million USD and above |

What Salary Is Considered Rich for a Single Person?

What salary is considered rich for a single person depends on location, lifestyle expectations, taxes, and long term financial planning. A high income alone does not guarantee wealth, but it does provide greater saving potential and faster asset accumulation.

In most developed countries, a single person earning significantly above the national median income is often viewed as rich, especially when living expenses are controlled and investments are prioritized.

Income vs Net Worth Difference

Income and net worth are closely related but represent different aspects of financial health. Understanding this difference helps explain why some high earners are not truly wealthy.

- Income refers to money earned regularly through salary, business, or freelancing

- Net worth represents total assets minus liabilities such as loans and credit debt

- High income with high expenses can result in low net worth

- Moderate income with consistent investing can build long term wealth

Net worth reflects financial stability and freedom, while income shows earning power. Being rich is more accurately measured by net worth rather than monthly or yearly salary.

Cost of Living Impact

Cost of living has a direct impact on how rich a salary feels in real life. The same income can support very different lifestyles depending on expenses.

| Location Type | Salary Considered Rich |

| Low Cost Areas | $70,000 to $90,000 annually |

| Medium Cost Cities | $100,000 to $150,000 annually |

| High Cost Cities | $180,000 or more annually |

Housing costs, taxes, healthcare, transportation, and lifestyle choices all influence purchasing power. In high cost cities, even six figure salaries may only support a comfortable lifestyle rather than true wealth.

Family & Household Wealth Standards

Family and household wealth standards focus on combined assets, shared expenses, and long term financial security. Wealth at this level is measured by stability, investment diversification, and the ability to support future generations.

What Family Net Worth Is Considered Rich?

Family net worth includes property, savings, investments, businesses, and retirement accounts shared among family members.

- $1.5 million to $3 million is considered wealthy for a family

- $3 million to $5 million is often viewed as rich

- $10 million or more defines very wealthy family status

Families with higher net worth usually benefit from multiple income sources, asset diversification, and strategic financial planning.

What Household Net Worth Is Considered Rich?

Household net worth measures the combined financial position of everyone living in the same household.

| Household Level | Net Worth |

| Financially Secure | $1 million |

| Rich | $2.5 million to $4 million |

| Very Wealthy | $7 million or more |

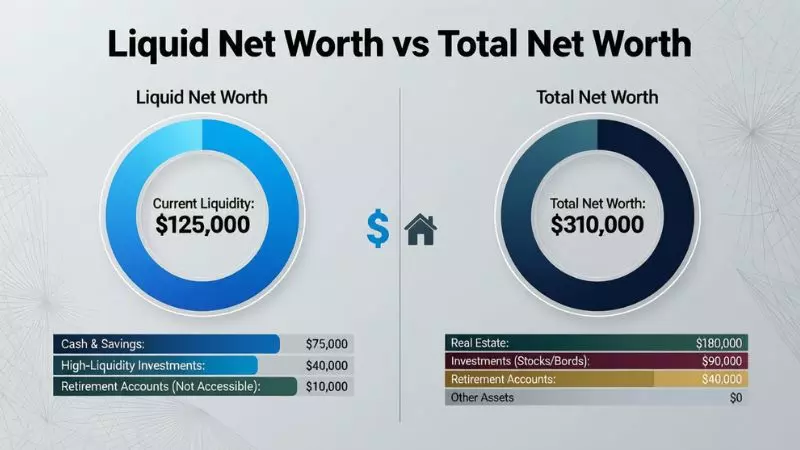

Liquid Net Worth vs Total Net Worth

Liquid net worth and total net worth are both important indicators of financial health, but they serve different purposes. Total net worth includes all assets such as real estate, business equity, retirement accounts, and investments minus liabilities.

Liquid net worth, on the other hand, focuses on assets that can be quickly converted to cash without losing value, such as savings accounts, stocks, and bonds. Understanding both helps determine true financial flexibility and wealth security.

What Liquid Net Worth Is Considered Rich?

Liquid net worth reflects your ability to access cash quickly for opportunities or emergencies. For most financial experts:

- $500,000 to $1 million in liquid assets is considered rich for an individual

- $1 million to $5 million provides significant financial freedom

- $10 million or more classifies an individual as ultra-liquid wealthy

High liquid net worth allows greater investment agility, supports major purchases without debt, and ensures comfort during unexpected events.

Why Liquid Assets Matter

Liquid assets are critical because they offer flexibility and financial security beyond long-term investments. Key reasons include:

- Immediate access to cash for emergencies or opportunities

- Reduces dependence on loans or credit during financial stress

- Provides peace of mind and financial independence

- Enables strategic investment moves without selling illiquid assets

While total net worth shows overall wealth, liquid net worth determines your actual ability to act on financial opportunities at any moment.

What Net Worth Is Considered Wealthy in Retirement?

Retirement wealth is measured not just by accumulated net worth but by the ability to maintain a desired lifestyle throughout retirement. Financial planners focus on sustainable income generation and asset management to ensure long-term security.

Retirement Lifestyle Tiers

Retirement wealth varies depending on lifestyle goals, location, and healthcare needs. Common tiers include:

| Tier | Net Worth | Lifestyle Description |

| Comfortable | $500,000 to $1 million | Covers basic needs, travel, and hobbies |

| Wealthy | $1.5 million to $3 million | Comfortable lifestyle, frequent travel, healthcare security |

| Ultra-Wealthy | $5 million or more | Luxury retirement with multiple properties, legacy planning, and private investments |

These tiers help retirees plan savings, investments, and withdrawals to maintain their chosen standard of living.

Safe Withdraw Strategy & Wealth Security

A safe withdrawal strategy ensures retirees preserve their wealth while generating consistent income. Key strategies include:

- 4% rule: Withdraw 4% of retirement portfolio annually to sustain long-term wealth

- Diversification: Balance between stocks, bonds, and liquid assets

- Emergency fund: Maintain cash reserves for unexpected expenses

- Tax optimization: Use tax-advantaged accounts for withdrawals to reduce liabilities

What Do People Think?

Understanding public perception of wealth provides a realistic perspective on what people consider rich. Online communities such as Reddit and Quora reveal diverse opinions influenced by lifestyle, location, and personal financial goals.

These insights help contextualize numbers with real-life experiences, showing that wealth is not only about figures but also about financial freedom, security, and lifestyle satisfaction.

Reddit Opinions on Being Rich

Reddit users often share candid perspectives on wealth, highlighting the difference between perceived and actual richness:

- Many consider a net worth of $1 million as the minimum to be “rich,” while others say $5 million is more realistic in high-cost cities

- Liquid assets and the ability to afford luxury without stress are emphasized over income alone

- Users note that being “rich” is relative to peers, region, and lifestyle expectations

- Achieving financial independence is often mentioned as a key factor in feeling wealthy

These discussions show that the definition of rich is highly subjective and shaped by personal priorities and life circumstances.

Quora Insights & Real-Life Perspectives

On Quora, experts and everyday users provide insights that balance practical and aspirational views:

- High net worth is often associated with diversified investments and passive income streams

- People highlight the importance of financial security, including retirement readiness and emergency funds

- Social comparison is common; many equate wealth to being in the top 10% of earners in their country

- Real-life stories emphasize disciplined savings, smart investing, and minimizing debt as paths to richness

Quora answers reveal that most users focus on long-term stability rather than short-term earnings, showing that net worth perception is as much about mindset as it is about numbers.

Final Thoughts

Evaluating what net worth is considered rich combines global benchmarks, lifestyle considerations, and personal financial goals. Wealth is not purely numerical; it includes freedom, security, and the ability to pursue one’s preferred lifestyle without financial stress.

Is “Being Rich” Relative?

Yes, being rich is highly relative:

- It depends on location, cost of living, and social circles

- Financial freedom often matters more than the actual dollar amount

- Lifestyle choices, debt, and spending habits influence perceived wealth

Ultimately, richness is a combination of financial strength, personal satisfaction, and life goals.

How to Grow Net Worth Faster

Growing net worth efficiently requires a combination of strategy, discipline, and smart investment decisions:

- Maximize savings and reduce unnecessary expenses

- Invest in diversified assets like stocks, real estate, and retirement accounts

- Focus on passive income streams for long-term stability

- Monitor net worth regularly to adjust financial strategies

- Avoid high-interest debt and leverage credit responsibly

Final Words

Determining What Net Worth Is Considered Rich depends on global standards, lifestyle expectations, and financial goals. Net worth combines assets like investments, savings, property, and business equity minus liabilities, giving a true picture of financial strength.

Being rich is not just about income but also about achieving financial freedom, long-term wealth stability, and the ability to maintain a comfortable lifestyle without relying on active earnings. Understanding What Net Worth Is Considered Rich helps individuals plan smarter investments, grow assets, and achieve financial security.

Frequently Asked Questions

What is considered a high net worth individual?

A high net worth individual typically has investable assets of $1 million or more, excluding their primary residence, indicating financial stability and wealth.

How much money makes someone rich globally?

Globally, a net worth of $2 million or more often places a person among the top wealth percentiles, reflecting luxury lifestyle potential and financial independence.

What net worth defines rich in the United States?

In the U.S., individuals with a net worth of $2.5 million to $5 million are usually considered rich, accounting for assets like investments, property, and savings.

Is being rich the same as being wealthy?

Being rich focuses on high income and spending power, while being wealthy emphasizes long-term net worth, financial security, and passive income generation.

How does location affect net worth considered rich?

Location impacts wealth perception; high-cost cities like San Francisco require higher net worth thresholds to be considered rich compared to smaller towns or developing countries.

Can someone earn a high salary but not be considered rich?

Yes, high earners may not be rich if expenses, debts, and lack of investments prevent significant net worth accumulation over time.

Hey there! I’m Sophie Lane, the creative mind behind CaptionRizz.com — your go-to space for everything witty, flirty, and full of charm. I’ve always believed that the right words can make anyone stand out — whether it’s a catchy Instagram caption, a smooth pick-up line, or the perfect rizz to impress someone special.

At CaptionRizz, my goal is simple: to help you express your mood, your style, and your personality through clever lines that grab attention. From romantic captions to bold one-liners, every piece is designed to make your words unforgettable.

I spend hours crafting original content that blends humor, confidence, and creativity — perfect for anyone who wants to upgrade their caption game or learn the art of modern “rizz talk.”

So whether you’re posting a photo, sliding into DMs, or just looking for that one perfect line — I’ve got you covered.

Let your words shine. Let your vibe speak.Welcome to CaptionRizz — where captions meet confidence. 💬✨